Bamboo Works Weekly: Time for a shift: SenseTime formalizes pivot to generative AI

This week in Bamboo Works:

SenseTime Group Inc. 0020.HK

Time for a shift: SenseTime formalizes pivot to generative AI

Cango Inc. CANG.US

Cango’s latest pivot uncovers gold in bitcoin mining

Beijing 51World Digital Twin Technology Co. Ltd.

Why aim small? 51World Digital Twin sets its sights on cloning Earth

Guming Holdings Ltd.

IPO tea party set to resume with Guming’s regulatory nod from China?

ZJK Industrial Co. Ltd. ZJK.US

ZJK eyes entry to big leagues with potential expansion of Nvidia partnership

Xiaocaiyuan International Holding Ltd.

Xiaocaiyuan sets the table for Hong Kong IPO. But is the timing right?

Cloudbreak Pharma Inc.

Cloudbreak Pharma sets sights on Hong Kong IPO after license deal

Wuhan Dazhong Dental Medical Co. Ltd.

IPO-bound Dazhong Dental all smiles in market ripe for consolidation

Bosideng International Holdings Ltd. 3998.HK

Bosideng chases Canada Goose with flight to high-end

Guangzhou Innogen Pharmaceutical Group Co. Ltd.

Innogen Pharma jostles for a slice of the weight-loss market

Gamehaus Holdings Inc.

Gamehaus courts investors with its China roots, international focus on casual games

Two IPOs: One in Autonomous Driving and One in Gold

As China’s IPO landscape continues to evolve, we’ve seen two recent listings that offer an intriguing glimpse into the country’s shifting market dynamics: one from the high-tech autonomous driving sector, and the other from the more traditional gold retailing space. Both tell us something important about the sectors they represent — sectors that have seen notable shifts in recent months.

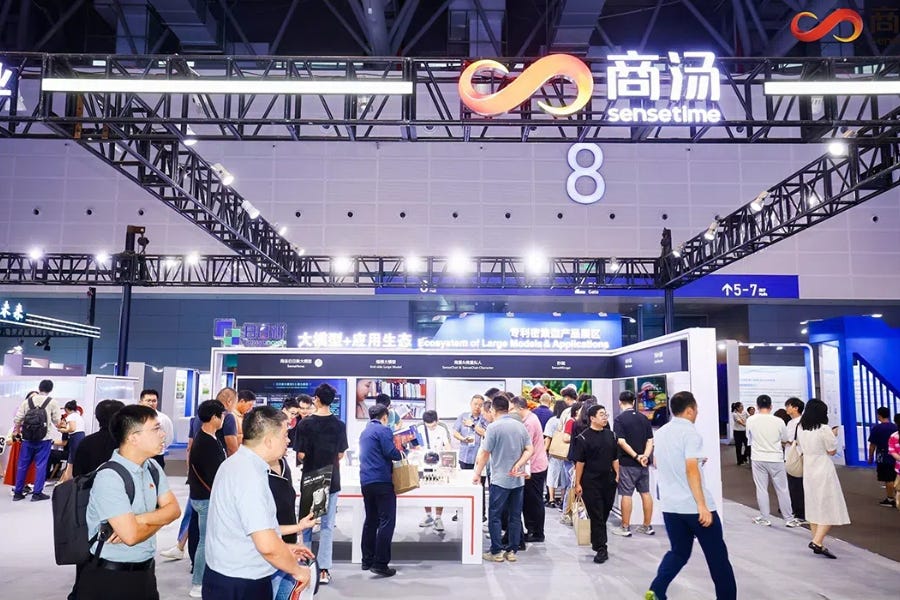

Time for a shift: SenseTime formalizes pivot to generative AI

Latest close: 1.55(-0.64%) ; 52-week range: 0.58-2.35

SenseTime Group Inc. (0020.HK) was one of China’s earliest pure artificial intelligence (AI) companies, making a name for itself in facial recognition. But as that technology becomes more controversial due to its use in surveillance, the company is sensing it’s time for a change and is going full throttle into the less controversial field of generative artificial intelligence (GenAI).

That shift was the subject of a sweeping new restructuring plan detailed in an internal memo from Chairman and CEO Xu Li, discussing the company’s prioritization of GenAI as its new primary growth driver.

Cango’s latest pivot uncovers gold in bitcoin mining

Latest close: 4.46(-2.62%) ; 52-week range: 0.94-4.85

Talk about big pivots.

After spending most of its life dealing in China’s vast car market, Cango Inc. (CANG.US) is charting a new direction into the digital realm, where it’s finding sudden profits in a brand-new bitcoin mining operation. The move was quite sudden, not even mentioned in Cango’s latest financial results and earnings call on Nov. 4.

Why aim small? 51World Digital Twin sets its sights on cloning Earth

Beijing 51World Digital Twin Technology Co. Ltd., a leader in this emerging field, is hoping to bring its virtual skills to the capital markets with its recent filing for a Hong Kong IPO, with CICC and Huatai International as joint sponsors. It’s the fifth tech company to file for an IPO under Hong Kong’s Chapter 18C introduced this year, easing requirements for “specialist technology companies.”

The digital twin concept at the heart of 51World’s business refers to digitally replicating and simulating physical objects, systems or processes from real life into the digital realm.

IPO tea party set to resume with Guming’s regulatory nod from China?

Sentiment towards the group got so bad that Mainland China’s securities regulator, the China Securities Regulatory Commission (CSRC), reportedly intervened in September by informally banning new bubble tea IPOs in Hong Kong.

Now, it appears that ban is quietly being lifted with the CSRC’s formal registration of the Hong Kong IPO plan from Guming Holdings Ltd., one of the other three companies besides Chabaidao to file IPO applications in January and February.

ZJK eyes entry to big leagues with potential expansion of Nvidia partnership

Latest close: 11.44(-7.74%) ; 52-week range: 4.00-30.50

In the world of high-tech components, it’s all about your customer list. Things like nuts and bolts and optical lenses rarely excite investors, even though they are critical components for a wide range of products. But when someone like Apple chooses your components for use in its iPhones or other products, that’s quite another story.

Newly listed ZJK Industrial Co. Ltd. (ZJK.US) was well aware of that fact when it announced a potential major expansion of its existing partnership with cutting-edge chipmaker Nvidia (NVDA.US) on Dec. 3.

Xiaocaiyuan sets the table for Hong Kong IPO. But is the timing right?

Sometimes delaying a lunch date can be a good thing. When Xiaocaiyuan International Holding Ltd. made its first application for a Hong Kong IPO back in January, it had just served up a tasty year financially in the domestic Chinese market for low-cost homestyle cooking, as consumers rushed to celebrate the end of pandemic restrictions.

But the financial market lacked appetite for new listings back then. In the first half of the year, new Hong Kong listings raised just HK$11.6 billion ($1.49 billion) across 27 deals, down 35% and 15%, respectively, year-on-year, according to accounting firm KPMG.

Cloudbreak Pharma sets sights on Hong Kong IPO after license deal

In the past week alone, 11 companies have applied to list their shares on the Hong Kong Stock Exchange, taking advantage of this year’s broader market recovery. The brighter mood has given some applicants fresh hope of success after failing in their previous attempts to go public.

One such hopeful is Cloudbreak Pharma Inc., a loss-making developer of drugs to treat eye problems such as short-sightedness and an ocular condition associated with outdoor sports.

IPO-bound Dazhong Dental all smiles in market ripe for consolidation

China’s dental market is a fragmented place, with chains taking only 3% of the market. That’s making the sector ripe for consolidation, something that Wuhan Dazhong Dental Medical Co. Ltd. may be considering with its plan to raise funds through a Hong Kong IPO.

The company is a relative old-timer in a market where advanced dental services are still quite new, boosted over the last decade by a growing Chinese middle class that can afford to think about things like braces, root canals and even teeth whitening.

Bosideng chases Canada Goose with flight to high-end

Latest close: 4.03(-2.66%) ; 52-week range: 3.21-5.14

China’s economy may be feeling some chills these days, plagued by slowing growth that’s dampening consumption and leading to cutthroat competition in many consumer sectors.

Despite that, leading down apparel maker Bosideng International Holdings Ltd. (3998.HK) managed to stay warm over the summer with financial results that look quite solid in such an uncertain climate.

Innogen Pharma jostles for a slice of the weight-loss market

Guangzhou Innogen Pharmaceutical Group Co. Ltd. recently applied to list on the main board, sponsored by CITIC Securities and CICC, shortly after an IPO application by China’s PegBio.

Innogen’s pitch to investors focuses on a drug described in the prospectus as the first humanized long-acting GLP-1 receptor agonist to have been developed in Asia.

Gamehaus courts investors with its China roots, international focus on casual games

When Gamehaus Holdings Inc., which publishes mobile games, finally goes public after a lengthy delay in its plan to merge with a special purpose acquisition company (SPAC), it will probably face a plenty of investor skepticism about its ability to maintain its growth story over the longer term.

Last month, the company formally registered its SPAC listing plan with the China Securities Regulatory Commission (CSRC), clearing a critical regulatory hurdle that was seemingly a factor in the listing’s lengthy delay.