Bamboo Works Weekly: Tencent Music scales audio heights with Ximalaya purchase

This week in Bamboo Works:

Tencent Music Entertainment Group TME.US 1698.HK

Tencent Music scales audio heights with Ximalaya purchase

Fosun International 0656.HK

Fosun jewelry unit mines gold from new investors even as its profit shrinks

Alphamab Oncology 9966.HK

Alphamab stake sale could signal harder times ahead

Banu International Holding Ltd.

Banu ladles up new hotpot choice for Hong Kong investors

ENN Natural Gas Co. Ltd. 600803.SH

ENN bids to reshape its gas business with listing switch-up

Shanghai Jin Jiang International Hotels Co. Ltd. 600754.SH

Checking out or checking in? Jin Jiang can’t decide

Unisound AI Technology Co. Ltd. 9678.HK

Unisound launches modest IPO into crowded Hong Kong market

Alsco Pooling Service Co. Ltd.

Alsco delivers new application on rocky road to a Hong Kong IPO

Switchbot (Shenzhen) Co. Ltd.

Switchbot taps market frenzy for robotic stocks

SICC Co. Ltd. 688234.SH

Sinking SICC looks for lift from Hong Kong IPO

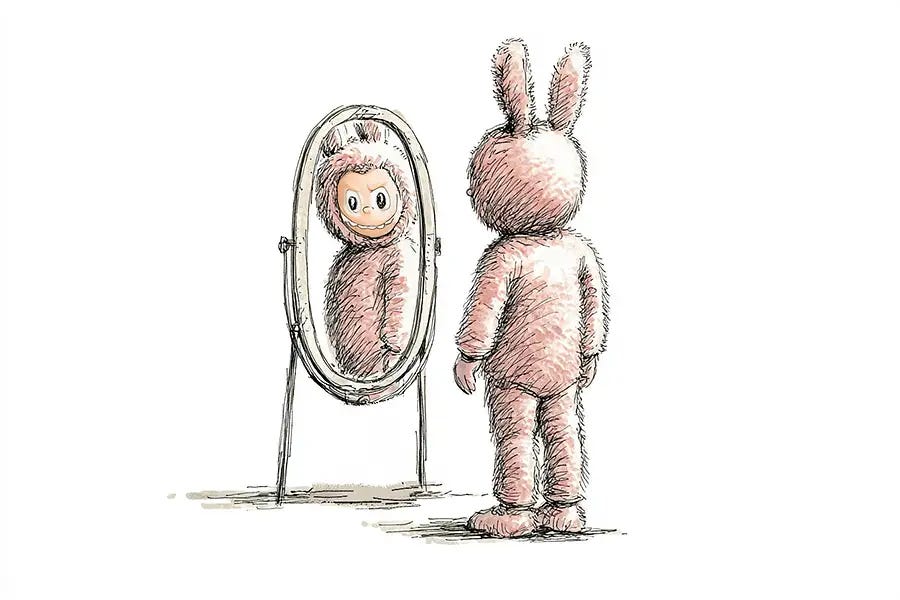

Labubu fever, and a skincare brawl

In all the recent economic gloom, two unrelated lighter stories have captured the public’s imagination. Both offer a familiar lesson in China’s fast-moving consumer landscape. The first is the speculative frenzy surrounding a collectible toy named Labubu, which has sent its creator’s stock soaring. The second is a vicious public battle between two leading skincare empires that has left one of them badly bruised. Together, they paint a vivid picture of markets driven as much by sentiment as by substance, where fortunes can be made — and lost — in an instant.

Tencent Music scales audio heights with Ximalaya purchase

Latest close: 18.48(-0.70%); 52-week range: 9.41-19.40

In today’s increasingly video-dominated media world, predictions of the death of audio formats like podcasts and audio novels may be slightly premature.

Tencent Music Entertainment Group (TME.US; 1698.HK), China’s leading online music streaming platform, gave the audio format a major vote of confidence with announcement of its plan to acquire Ximalaya Inc., using the purchase to fill an important gap in its long-form audio segment.

Fosun jewelry unit mines gold from new investors even as its profit shrinks

Latest close: 4.42(0.00%); 52-week range: 3.74-6.23

Attracting fresh capital for a business that’s losing its luster isn’t easy. But conglomerate Fosun International’s (0656.HK) jewelry subsidiary has done just that by lining up an army of investors to shore up its business that doesn’t look so shiny at the moment.

Fosun said that Bank of China Financial Asset Investment agreed to buy 400 million yuan ($55.7 million) worth of new shares in Shanghai Yuyuan Jewelry Fashion Group, giving it a 3.6% stake in the company.

Alphamab stake sale could signal harder times ahead

Latest close: 6.79(-2.02%); 52-week range: 2.10-9.23

China’s drug discovery sector has roared back to life this year after a three-year slump, leading a rally in the overall Hong Kong stock market.

One of the standout performers has been cancer therapy specialist Alphamab Oncology (9966.HK), which more than doubled in market value, outstripping a 65% overall jump in the Hang Seng Innovative Drug Index.

Banu ladles up new hotpot choice for Hong Kong investors

A new Hong Kong IPO application by hotpot chain Banu International Holding Ltd. is offering a complex mix of the latest restaurant trends in China, suggesting consumers are becoming more frugal but also continue to enjoy dining out.

Banu is one of several restaurant operators lining up to list in Hong Kong, in what could be one of the larger such IPOs from that group, raising up to $100 million. The company positions itself at the premium end of the hotpot market.

ENN bids to reshape its gas business with listing switch-up

Chinese energy enterprise ENN Natural Gas Co. Ltd. (600803.SH) is taking an unusual route to becoming a dual-listed company. It will not have to issue any new shares along the way, but the process is by no means straightforward.

The proposed maneuver involves buying out shareholders in a listed subsidiary then effectively taking that unit’s place on the Hong Kong stock market, as the combined company bids to streamline its gas operations and raise its profile with international investors.

Checking out or checking in? Jin Jiang can’t decide

The opening chapter of “Romance of the Three Kingdoms,” one of China’s four great classical novels, says the world operates in cycles of long periods of division, followed by reunification, before more division.

That same rule applies in the capital market these days to Jin Jiang Capital Co. Ltd. The company, one of China’s three largest hoteliers, checked out of the Hong Kong stock market three years ago with its privatization. But now its 45%-owned company, the similarly named Shanghai Jin Jiang International Hotels Co. Ltd. (600754.SH), is saying it plans to make a second listing in Hong Kong.

Unisound launches modest IPO into crowded Hong Kong market

Is the market for new AI listings becoming oversaturated?

That question was front-and-center in the latest listing document from Unisound AI Technology Co. Ltd. (9678.HK), which launched its Hong Kong IPO on Friday with a very modest fundraising target of up to HK$320 million ($41 million). The company plans to sell 1.56 million shares in the listing, representing just 2.2% of its share capital, which seems to show it’s not extremely confident of big demand for the stock.

Alsco delivers new application on rocky road to a Hong Kong IPO

Alsco Pooling Service Co. Ltd.’s second application to list on the Hong Kong Stock Exchange, filed, marked a comedown from its original application last November, when the company’s business was riding high but later got tripped up by compliance issues.

Notably, the latest filing shows Alsco’s business slowed sharply in the second half of last year, after the earlier application showed a much stronger start to 2024.

Switchbot taps market frenzy for robotic stocks

Robotic stocks are on a tear lately, lifted by recent events like a dancing robot performance on China’s widely watch annual Spring Festival Gala TV program, and repeated hype from Jensen Huang, CEO of Nvidia, saying the robot era is drawing near.

Piloting into that buzz is smart home-focused Switchbot (Shenzhen) Co. Ltd., which hopes to tap excited investors for cash with its plan for a Hong Kong listing.

Sinking SICC looks for lift from Hong Kong IPO

What a difference four months makes.

When semiconductor company SICC Co. Ltd. (688234.SH) first filed to list in Hong Kong back in February, it was boasting strong double-digit revenue growth and was on track to report its first annual profit. The company’s Hong Kong listing, which was just approved by China’s securities regulator, would complement its existing listing on Shanghai’s STAR Market.