Bamboo Works Weekly: Dancing robot sensation Unitree boogeys towards IPO

This week in Bamboo Works:

Unitree Robotics

Dancing robot sensation Unitree boogeys towards IPO

Zai Lab Ltd. 9688.HK ZLAB.US

Zai Lab under pressure over clinical results and rival drugs

China Resources Beverage (Holdings) Co. Ltd. 2460.HK

Can CR Beverage turn the tide after losing brutal water fight?

Hello Group Inc. MOMO.US

Hello Group takes ‘Cyrano approach’ in bid to rekindle China’s dating interest

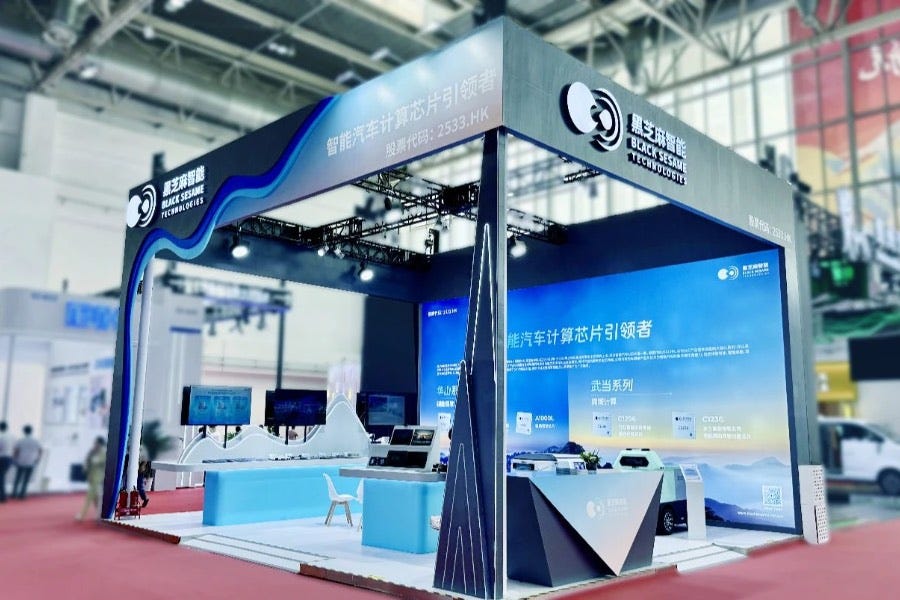

Black Sesame International Holding Ltd. 2533.HK

Black Sesame throws down the gauntlet to Qualcomm in autonomous driving race

Linklogis Inc. 9959.HK

Linklogis deepens its blockchain bet to make supply chain finance great again

Proya Cosmetics Co. Ltd. 603605.SS

Can Proya export its story to become a global makeup artist?

Huitongda Network Co. Ltd. 9878.HK

Huitongda puts its cash to work with investment in struggling supplier

SUNeVision Holdings Ltd. 1686.HK

SUNeVision profit rises, but near-term pressures worry investors

Senasic Electronics Technology Co. Ltd.

Senasic seeks fast start as automotive sensor market takes off

China’s state-driven stocks, and its corporate wars abroad

On the surface, a stock market boom in China has little in common with a food delivery turf war in São Paulo. Yet, the state-driven frenzy lifting Chinese stocks and the bare-knuckle brawl between Meituan (3690.HK) and DiDi both spring from the same source: a unique domestic ecosystem whose characteristics the world is only now beginning to fully comprehend.

Dancing robot sensation Unitree boogeys towards IPO

Chinese startup Unitree Robotics has become a star on the emerging humanoid robot stage over the past two years, after a dancing performance by its products on China’s widely watched Lunar New Year’s Eve Gala went viral in January.

Seizing on the heightened attention, the company now plans to take its rising star to the capital markets, announcing that it intends to file for an IPO on an unspecified stock exchange by the end of this year. The pronouncement officially confirms months of media speculation about such a listing, with Reuters reporting Unitree is aiming for an IPO valuation of $7 billion.

Zai Lab under pressure over clinical results and rival drugs

Latest close: 26.04(+7.43%); 52-week range: 15.50-35.50

Clinical disappointments may be a common risk factor in drug development, but they still have the power to rattle investors.

When Zai Lab Ltd. (9688.HK; ZLAB.US) issued a short statement saying that one of its core products had suffered a Phase Three setback, the news punctured some of the high hopes that had built up around the drug, sending the firm’s Hong Kong-listed shares into a tailspin.

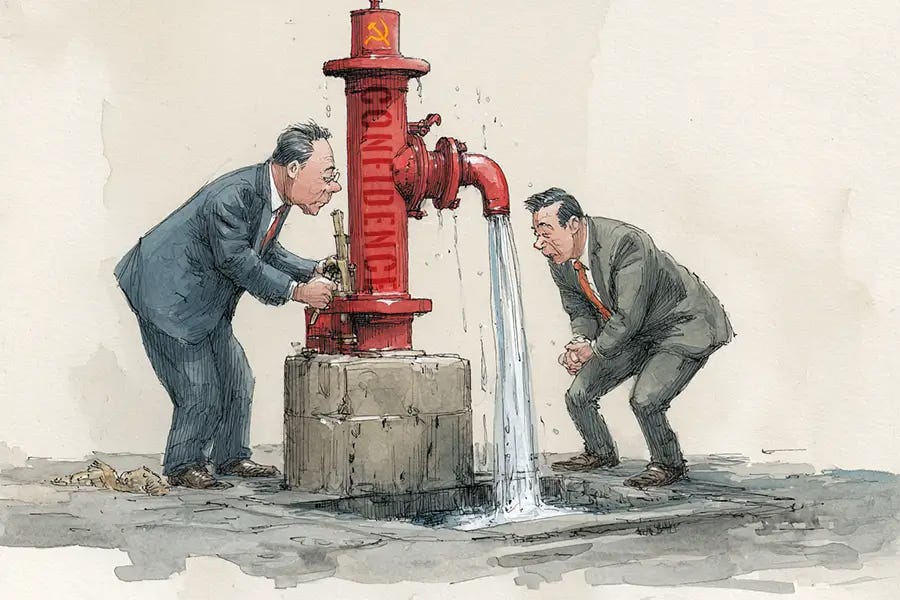

Can CR Beverage turn the tide after losing brutal water fight?

Latest close: 11.19(-1.41%); 52-week range: 10.30-16.78

China’s beverage market is vast but also fiercely contested, particularly when it comes to bottled water that’s peddled in virtually every convenience store, eatery and supermarket across the country.

China Resources Beverage (Holdings) Co. Ltd. (2460.HK) is a leading player in that space, providing a new investment alternative when it listed in Hong Kong last year alongside industry leader Nongfu Spring (9633.HK).

Hello Group takes ‘Cyrano approach’ in bid to rekindle China’s dating interest

Latest close: 7.48(-0.66%); 52-week range: 5.12-9.22

Could a dating approach used by the fictional Cyrano de Bergerac finally halt the revenue slide that has plagued dating app operator Hello Group Inc. (MOMO.US) for the last five years?

It was hard to tell in the company’s latest financial report, which showed the its revenue continued to fall in the second quarter, extending a long string of declines dating back to 2020.

Black Sesame throws down the gauntlet to Qualcomm in autonomous driving race

Latest close: 18.03(-0.50%); 52-week range: 14.50-43.85

Among that wave, Black Sesame International Holding Ltd. (2533.HK) — fresh off the one-year anniversary of its Hong Kong listing — showed it still has a ways to go with a midyear financial report revealing a continuing sea of red ink.

But the report also contained a silver lining in the form of rapid revenue growth, which clocked in at 40% in the first half of 2025.

Linklogis deepens its blockchain bet to make supply chain finance great again

Latest close: 3.26(+1.87%); 52-week range: 0.99-3.34

It’s no secret that cryptocurrencies have the potential to revolutionize financial transactions. But one lesser-known area that can also benefit nicely from digital asset technology is supply chain finance.

At least that’s what Linklogis Inc. (9959.HK) seems to believe, as it looks past its traditional reliance on China’s slumping property sector to try to find its way back to growth.

Can Proya export its story to become a global makeup artist?

Proya Cosmetics Co. Ltd. (603605.SS) achieved a major feat in 2024, becoming the first Chinese cosmetics company to log sales of over 10 billion yuan ($1.4 billion).

That milestone represented an important advance in the company’s 10-year plan to become one of the world’s top 10 cosmetics companies, which would require annual revenue of 50 billion yuan, according to founder and Chairman Hou Juncheng.

Huitongda puts its cash to work with investment in struggling supplier

Latest close: 13.70(+0.96%); 52-week range: 10.24-26.65

What do you do when you’re sitting on a large pile of cash from an e-commerce business that’s big but not extremely profitable?

If you’re Huitongda Network Co. Ltd. (9878.HK), you spend a chunk of that money to buy a sizable stake at a big discount in a supplier that’s fallen on hard times but could soon return to health following a reorganization.

SUNeVision profit rises, but near-term pressures worry investors

Latest close: 6.94(+0.87%); 52-week range: 3.21-10.36

Booming demand for low-latency data processing fueled by AI inference engines, cross-border e-commerce platforms and financial trading systems is transforming Hong Kong to an important gateway between China and the rest of the world for data centers.

One player that’s well-placed to benefit from that trend is SUNeVision Holdings Ltd. (1686.HK), though the data center operator’s latest annual results failed to impress investors.

Senasic seeks fast start as automotive sensor market takes off

A leading Chinese maker of automotive sensor chips, Senasic Electronics Technology Co. Ltd., is now inviting investors to help fund its expanding business through a share listing on the Hong Kong Stock Exchange.

To do so, investors will have to look past the firm’s chronic losses and consider the potential for profit down the road.